The Challenge

Rising costs, complex regulatory requirements, siloed data, and talent shortages present significant challenges for the reinsurance industry, creating bottlenecks that hinder rapid, accurate decision-making.

To remain competitive, it is crucial to adopt solutions that address these issues and adapt to future demands.

The Challenge

Rising costs, complex regulatory requirements, siloed data, and talent shortages present significant challenges for the reinsurance industry, creating bottlenecks that hinder rapid, accurate decision-making.

To remain competitive, it is crucial to adopt solutions that address these issues and adapt to future demands.

The Solution

Reinsurance Underwriting Workbench is a modular application tailored for reinsurers to get a headstart on streamlining and optimizing the underwriting process. It integrates seamlessly with existing systems and supports end-to-end workflows – from initial case ingestion to final decision – speeding case turnaround time by up to 40%.

Unlike other commercial software, the Workbench provides “digital agility” by helping you enhance efficiency, accuracy, and speed – but just as importantly – adds the ability to pivot when new regulations take the industry by surprise or when you need to stay ahead of the competition by introducing new features or offerings.

Get Future Fit

Innovate Faster

Unlock Your Data

Functional Design

Enrich Your Workbench with Data and Automation

-

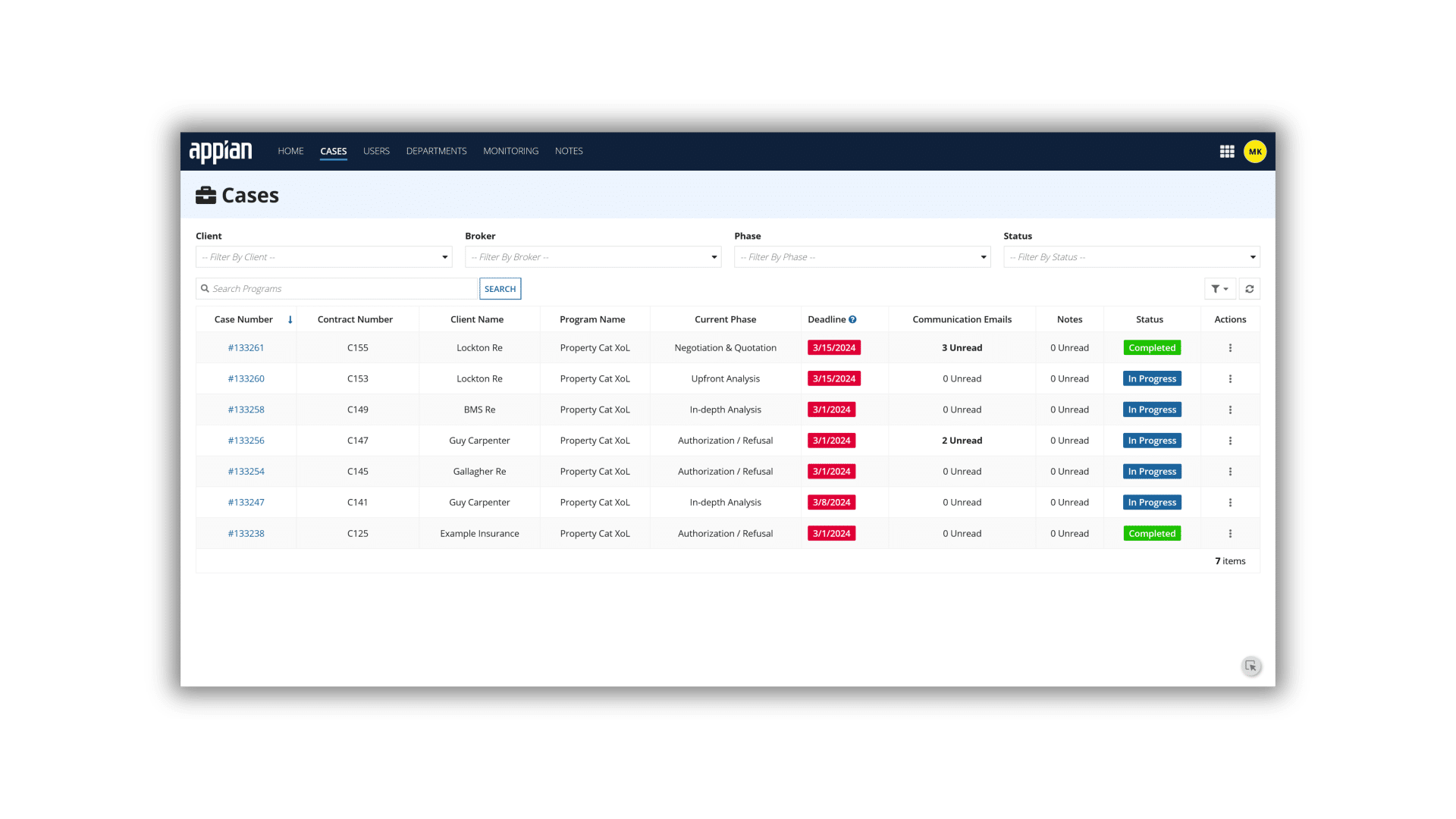

End-to-End Processing

Manage all pre-bind activities from initial case ingestion to final decision

-

Caseload Management

Pre-qualify and prioritize cases for better business outcome

-

Improved Broker Experience

Reduce email chains, duplicate work and incomplete communications

-

AI Foundation

Leverage AI for document summarization, case opinions and suggested next actions

-

Enhance visibility and coordination among all process stakeholders

Create the Reinsurance Suite that's Right for You.

- The rapid speed and agility enabled by low-code means this is just the start of your Reinsurance Suite. While Underwriting is a common starting point for many reinsurers, the fact is, you can start anywhere:

- Streamline claims processes to reduce turnaround times and increase customer satisfaction

- Automate policy issuance, renewals, and endorsements to ensure accurate management of policy lifecycles

- Utilize AI and analytics to evaluate risk profiles to strengthen decision-making and pricing strategies

Where in your business would automating complex processes and combining previously siloed data and logic help to free up staff to focus on helping clients make better decisions? Let’s start there.

The Benefits of a Low-Code Platform

Unlock Your Data

Accessing, ingesting, and analyzing data is a chief concern for insurers.

Our platform helps remove the challenge from integration and lets you incorporate new technologies, data sources, APIs and AI.

Foster Reuse

Speed up innovation and reduce costs by leveraging reusable components.

Use skills, objects, APIs, and rules from your first project (i.e. Underwriting) to speed up future applications (i.e. Claims, Treaty Management)

Functional Design

Employees and customers expect intuitive solutions that are easy to use.

Build modern user experiences that free staff to focus on high-value tasks that help clients shape better decisions.

Future Proof Your Organization

Stay ahead of technology trends with a platform where digital agility is built-in at every level. Low-code ensures you’re able to innovate when you are ready. Don’t let vendors dictate your roadmap.